High-Risk Auto Insurance: Overview

High-Risk Auto Insurance: Top Choices

Here’s how we rated the best insurers for high-risk drivers:

| Auto Insurance Provider | Designation | Our Rating |

|---|---|---|

| Travelers | Most Coverage Options | 9.5 |

| State Farm | Best Customer Experience | 9.4 |

| USAA | Best for Military Members | 9.2 |

| Nationwide | Low Rates for Speeding Tickets | 9.1 |

| Geico | Low Rates for Teen Drivers | 9.1 |

| Progressive | Low Rates for DUIs | 9.0 |

High-Risk Auto Insurance: Overview

Drivers in the high-risk category may be there for a single reason or a combination of many. Potential high-risk factors include:

- Younger and new drivers

- Drivers with a conviction for driving under the influence (DUI)

- Drivers with speeding tickets or other moving violations

- Drivers with multiple at-fault accidents

- Drivers with a reckless-driving conviction

- Drivers with lapses in insurance coverage

- Drivers with bad credit scores

These risk factors are largely what the best high-risk auto insurance companies use when setting premiums since they may increase the likelihood a driver will file a claim. People with very few of these factors are considered low-risk drivers by insurers since they have a smaller probability of filing a claim. As a result, they tend to pay lower premiums.

People with more than one of these factors may be considered high-risk drivers. These motorists will almost certainly face higher premiums and may have trouble finding coverage at all.

High-Risk Auto Insurance Cost

*Note: Unless otherwise stated, the average rates quoted in this article are for full–coverage car insurance. Cost data for high-risk drivers uses the profile of a 35-year-old male driver unless otherwise noted. We compare these rates to national averages for the standard driver profile of a 35-year-old with a clean driving record and good credit unless otherwise noted.

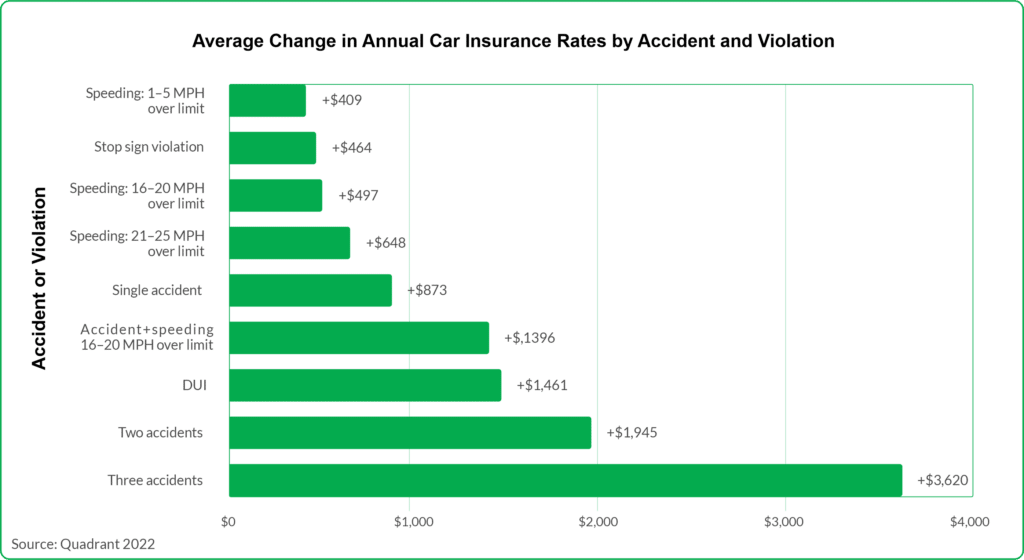

In most cases, high-risk car insurance will cost substantially more than the average annual auto insurance premium of $1,730 for full coverage. Your risk factors can add to your premium depending on the reason and provider.

The table below shows leading providers’ average rates for high-risk drivers. These figures are based on the combined averages for several risk factors: a younger driver with a DUI, a ticket for driving 21 to 25 mph over the speed limit and three accidents.

| Auto Insurance Provider | Average Annual Rates for High-Risk Drivers |

|---|---|

| State Farm | $2,006 |

| Travelers | $2,099 |

| USAA | $2,245 |

| Nationwide | $2,511 |

| Progressive | $2,714 |

| Geico | $2,824 |

The best high-risk car insurance companies all count infractions and risk factors slightly differently. That means the provider that offers the cheapest rates for high-risk drivers in one category may not work well for drivers in other groups.

Auto Insurance for DUI

Being convicted of driving while under the influence (DUI) or driving while intoxicated (DWI) is serious enough to earn you criminal penalties in many states. It’s also likely to significantly increase your car insurance premium. In the table below, you’ll find the lowest average rates on car insurance for drivers with a DUI.

| Auto Insurance Provider | Average Annual Rate for DUI |

|---|---|

| State Farm | $2,194 |

| Travelers | $2,218 |

| Progressive | $2,548 |

| USAA | $2,721 |

| Nationwide | $3,288 |

| Geico | $3,641 |

Auto Insurance for Speeding Tickets

The best high-risk auto insurance companies assign different levels of severity to speeding tickets based on a driver’s recorded mph over the speed limit. Any speeding ticket or traffic violation will likely raise your rate, but the increase will be higher if you have a more severe infraction.

The following table shows some average rates for drivers ticketed for going 21 to 25 mph over the speed limit.

| Auto Insurance Provider | Average Annual Rate for Severe Speeding Tickets |

|---|---|

| USAA | $1,828 |

| State Farm | $1,872 |

| Nationwide | $1,878 |

| Travelers | $1,970 |

| Geico | $2,137 |

| Progressive | $2,541 |

Auto Insurance for Multiple Accidents

Depending on your provider and policy, one at-fault accident may not cause your premium to increase by much. However, having multiple car accidents on your driving history will almost always cause your rate to spike. You’ll find average rates for drivers with three accidents on their driving records in the table below.

| Auto Insurance Provider | Average Annual Rate for Multiple Accidents |

|---|---|

| State Farm | $1,953 |

| Travelers | $2,110 |

| USAA | $2,187 |

| Nationwide | $2,368 |

| Geico | $2,694 |

| Progressive | $3,052 |

Auto Insurance for Teen Drivers

Younger drivers are statistically far more likely to get into collisions. As a result, teen drivers face some of the highest rates on car insurance, even if they have clean driving records. The table below shows the providers with the most affordable average rates for 16 year old drivers.

| Auto Insurance Provider | Average Annual Rate for Teens |

|---|---|

| Nationwide | $4,835 |

| Geico | $5,307 |

| Travelers | $5,436 |

| State Farm | $5,514 |

| USAA | $6,431 |

| Progressive | $10,139 |

Car Insurance Cost Factors

The categories above aren’t the only ones that factor into your car insurance rate. Insurers also use the following variables to determine the rates they charge:

- Location: Prices differ between states but also vary within them. Drivers in areas with high crime rates or extreme weather often pay higher auto insurance premiums.

- Credit score: In states where it’s legal to do so, insurance companies use your credit history as a factor in your rate. Drivers with poor credit scores are considered much less likely to pay, so insurers usually charge them higher rates.

- Marital status: Married drivers are more likely to bundle their auto coverage with other types of insurance or insure multiple vehicles, so they tend to pay less for car insurance.

- Vehicle: Several details about your vehicle — including its value, condition and mileage — help determine your premium.

- Coverage: The type of insurance coverage you have and the policy limits you set have a major impact on your rate.

- Deductible: You can typically choose your deductible, which is your out-of-pocket cost before your insurer compensates you for a covered loss. Generally, your auto insurance rate will be higher if you have a lower deductible.

- Discounts: Just because you have blemishes on your driving record or other risk factors doesn’t mean you can’t save on coverage. Most insurers offer a few car insurance discounts you might qualify for.

High-Risk Auto Insurance Coverage

Those with poor driving records often pay more for car insurance, but they have access to the same coverage as other drivers. The best high-risk auto insurance companies offer a similar set of coverage options that most drivers have access to. You’ll also find coverage options that can be added to your car insurance policy depending on your provider.

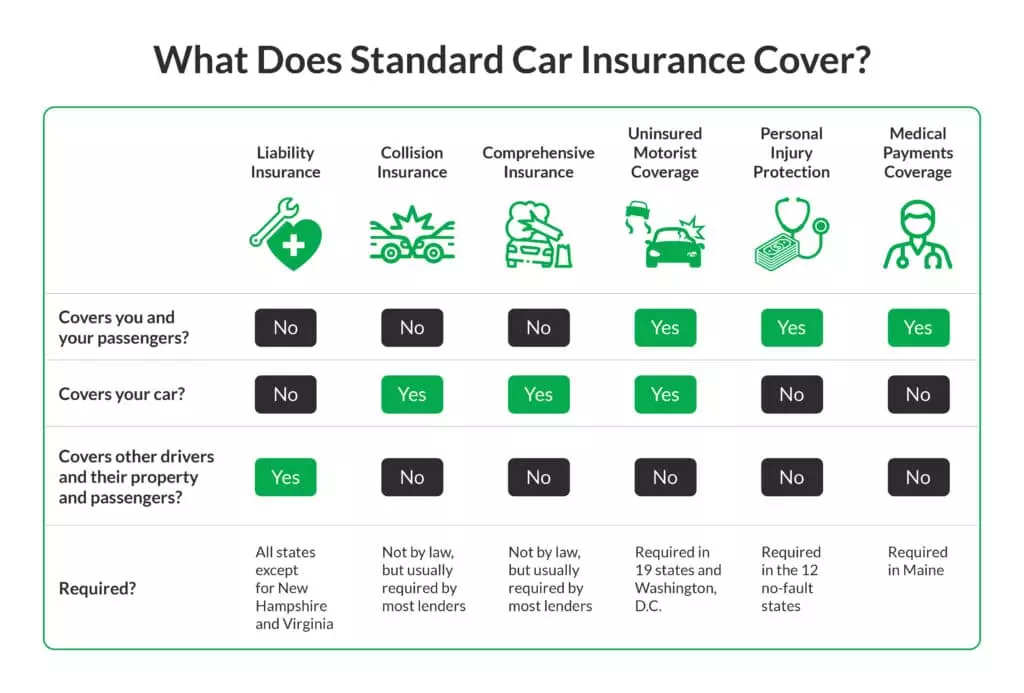

Standard Car Insurance Coverage

Every state that requires car insurance requires liability coverage, and some states mandate additional coverage types. Standard insurance coverages include:

- Bodily injury liability (BI): Covers medical expenses and lost wages for other parties in an accident you’re found at fault for

- Property damage liability (PD): Covers the cost of damages to other vehicles and property in an accident for which you are found at fault

- Personal injury protection (PIP): Covers lost wages and medical bills for you and your party, regardless of who caused an accident

- Medical payments coverage (MedPay): Covers medical costs but not lost wages for people in your party, regardless of who the at-fault driver is

- Uninsured motorist coverage: Covers your party’s medical expenses and property damages if an at-fault driver lacks sufficient coverage

Additional Coverage Options

The best high-risk auto insurance companies also offer optional coverages. Combining state-required liability and injury protection with the following options gives you what’s known as full coverage auto insurance:

- Collision coverage: Covers damages to your vehicle and personal property in a covered accident, no matter who’s found to be at fault

- Comprehensive coverage: Covers damages to your vehicle from sources other than accidents, such as theft, hail or flooding

Most insurers offer other nonstandard insurance options, such as roadside assistance, rental car reimbursement and accident forgiveness. These can offer peace of mind and additional support, but they’ll also add to your total cost of coverage.

Best High-Risk Auto Insurance Companies

While State Farm is our top pick overall, your best high-risk car insurance company depends on your situation. In addition to varying rates, providers offer different coverage options, benefits and customer service.

State Farm:

Best Customer Experience & High-Risk Auto Insurance With low rates for high-risk drivers and discounts like Drive Safe and Save, State Farm tops for customer experience and high-risk auto insurance. It offers reliable roadside assistance and tailored discounts for new drivers.

USAA:

Best for Military Members For eligible high-risk drivers, USAA offers competitive rates and high customer satisfaction. It's renowned for its service quality and consistently ranks well in industry studies.

Nationwide:

Best for Usage-Based Insurance Nationwide provides competitive rates, especially for drivers with severe speeding tickets. Its SmartRide program incentivizes safe driving, adding value for high-risk drivers.

Geico:

Best for Budget-Conscious Drivers Geico offers affordable coverage for teen drivers and various discounts, including Geico DriveEasy. Its rates make it an attractive option for budget-conscious customers.

Progressive:

Best for Tech-Savvy Drivers Progressive's long history of insuring high-risk drivers ensures competitive rates, especially for DUIs and severe speeding tickets. Progressive Snapshot rewards safe driving habits.

Travelers:

Best for Most Drivers While not the cheapest, Travelers offers affordable rates for high-risk drivers and discounts for students. Its Travelers Intellidrive program makes it appealing for most motorists.

How To Get Cheap High-Risk Auto Insurance

Unfortunately, even the best high-risk car insurance companies will likely charge you high rates if you’re considered a high-risk driver. While there’s little you can do to change your age or driving record, there are some factors that are still within your control as you attempt to find cheap car insurance.

Skip the Add-Ons

Even if you’re a high-risk driver, your state only requires you to carry minimum coverage. However, requirements from your lender or lessor may force you to purchase additional coverage, such as comprehensive and collision.

Removing unnecessary coverage is an easy way to trim your car insurance bill down, so consider which coverages you can skip.

Increase Your Deductible

Raising your auto insurance deductible is another way to reduce your rate. You will, however, have to pay more out of pocket for repairs or a total loss. Weigh that risk alongside any savings you might receive.

Complete a Safe Driving Course

Many insurance companies offer a discount for completing an approved safe driving course. Completing one of these courses will reduce your rate and has the potential benefit of improving your driving skills and awareness.

Remember, insurance rates are based on risk. If an insurance company gives you a lower rate, it’s because the math suggests you’re less likely to file a claim. This shows how effective defensive driving courses are at reducing accidents and violations.

Look for Discounts

Being labeled as a higher-risk driver won’t make you ineligible for car insurance discounts. Most insurers will have at least one or two discounts you can take advantage of. These are some of the most common:

- Auto pay: Set up automatic payments.

- Multi-policy: This is also known as a bundling discount, and you can often save by combining your auto policy with other products like homeowners, renters or life insurance.

- Multi-vehicle: Insure multiple vehicles under the same policy.

- Safe driver: People who keep clean driving records for a specific period of time can save on their premium.

- Good student: Take advantage of discounts for maintaining good grades in school.

- Military: Insurers offer savings for members of the military and their families.

Watch Your Credit Score

California, Hawaii, Massachusetts and Michigan have laws preventing insurers from using your credit score as a factor in setting rates. In every other state, your credit score can have a major impact.

Drivers with lower credit scores typically pay higher rates for car insurance than those with better scores. Practicing good financial habits and learning how to improve your credit score can help you get better rates, even if you have multiple infractions on your driving record.

Try Pay-Per-Mile Insurance

With most car insurance policies, you’ll pay a flat rate for coverage. But the best high-risk auto insurance companies offer usage-based insurance programs that charge you based on how much you actually drive your vehicle.

If you rarely need to drive or can limit your time behind the wheel, using one of these programs could be a good way to save on high-risk auto insurance. Just keep in mind that if you use your car too often, you’ll end up paying more.

Use a Telematics Program

Most major providers offer a telematics insurance program that can use data from your phone’s GPS or a device that plugs into your vehicle to monitor your driving habits. If you avoid risky behaviors like accelerating too quickly, slamming on your brakes or looking at your phone while driving, you’ll be rewarded with a lower rate.

However, these programs can also cause your rates to go up. If you practice too many unsafe driving habits, your car insurance could get even more expensive. Our team has also reviewed the best telematics apps.

Shop Around for Coverage

Getting car insurance quotes from several providers is one of the most important steps in getting cheap coverage from the best high-risk auto insurance companies. As seen from our cost data, the insurer that offers the cheapest rates depends a lot on the motorist who is shopping for insurance.

Even if you’re a high-risk driver, factors other than your driving record or age will come into play. You won’t really know how much an insurance company could charge you until you get a quote. Then, compare rates to find the most affordable car insurance.

Comments

Post a Comment